How to Calculate Effective Gross Income

A commercial real estate property’s potential income isn’t just the monthly rents times twelve. Such a simple approach misses additional revenue sources and potential costs, and thus doesn’t fully and accurately reflect the income that the property should generate. Instead, calculating effective gross income provides a much more accurate estimate of potential income.

What is Effective Gross Income (EGI)?

Effective gross income (EGI) projects the true expected income that a commercial real estate property should generate. It includes rental payments but isn’t limited to only them. The metric also takes into account other revenue sources, and costs that may decrease rents.

EGI can be thought of as the revenues or income that a property is expected to generate. The metric is most often used as a forward-looking forecast rather than a past-looking actual record.

Why Do Investors Need to Understand Effective Gross Income?

Investors need to understand effective gross income for a couple of reasons, not the least of which is because understanding a property’s income is essential to accurately valuing the property.

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

Accurately Assess Value

First and foremost, investors can’t accurately assess property value without knowing what the property’s income should be. Forgetting supplemental revenue streams can result in a property valuation that’s far below what it should be, and ignoring lost rents can result in a valuation that’s much too high.

The vast majority of commercial real estate properties are at least partly valued according to their income. Valuations are only as reliable as the figures — including the expected income figure — that investors use.

Meet Lender Financial Requirements

Second and also significantly, EGI is needed to calculate both net operating income (NOI) and pre-tax cash flow. NOI subtracts operating expenses from EGI, and pre-tax cash flow uses NOI plus other figures.

Lenders will check NOI when underwriting financing for a commercial real estate property. When financing isn’t used, pre-tax cash flow is a standard metric that investors evaluate.

The Formula for Calculating Effective Gross Income

Effective gross income is calculated using four metrics:

- Rental Gross Potential Income: Rental GPI represents the total income that’d be received if a property were fully rented for one year.When all rented space is charged the same rate, calculating rental GPI is simple. Multiply the rate charged by the number of rented units, or multiply the rate by the square footage that’s rented. If different tenants pay different rates, then the calculation is more nuanced and must be completed on a lease-by-lease basis.

- Other Income: Other income encompasses all revenues that aren’t regular rent payments. Multifamily commercial real estate properties might have parking fees, storage unit fees, coin-op laundry machines, pet fees, gym fees and other income sources. Late fees and lease termination fees also are included in this category.

- Vacancy Costs: Few commercial real estate properties are fully rented for an entire year. All investors should plan for at least some vacancies, and that’s what vacancy costs allow for. Vacancy costs account for the expected rents that aren’t collected when units aren’t actively leased.

- Credit Costs: Investors must also account for nonpayment, which is what credit costs does. Credit costs account for rents that tenants don’t actually pay, even though they lease and occupy a unit.

Both vacancy costs and credit costs can be particularly difficult to forecast. Investors who don’t have property-specific data to use should check what the rates are for similar properties.

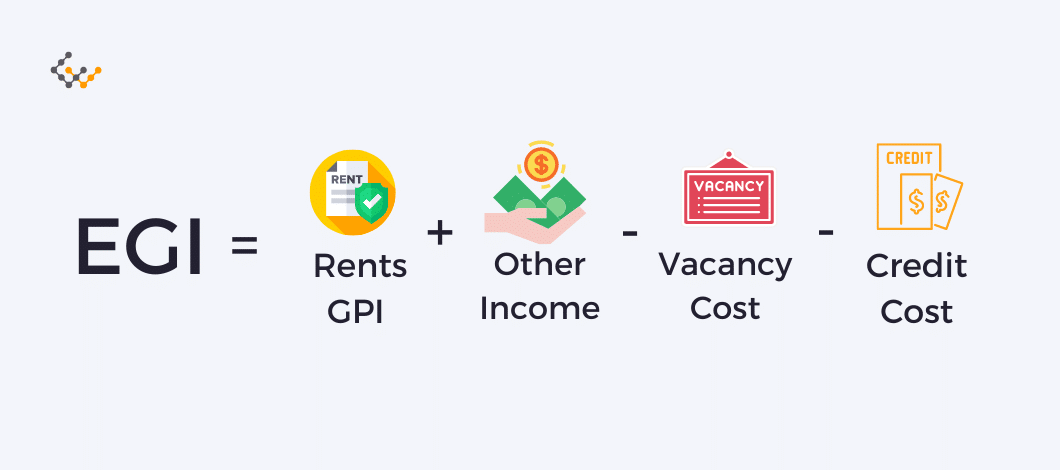

With these understood, the effective gross income formula is as follows:

EGI = Rental GPI + Other Income – Vacancy Costs – Credit Costs

Examples of How to Calculate Effective Gross Income in CRE

Multifamily Residential Real Estate Example

For an example, consider how effective gross income would be calculated for the following multifamily property.

The multifamily property has 20 identical units that each rent for $800 per month. Half of the tenants pay an extra $50 per month for a second parking space, and half also pay $40 per month for a storage unit in the building’s basement. Everyone uses the coin-op laundry, to the average tune of $20 per month.

The property’s tenants are generally reliable and stable. One tenant regularly pays rent late, but consistently includes the $30 late fee with their rent each month. Another tenant typically misses two months’ rent when their seasonal job ends, and these two months’ payments are unreliable. The overall vacancy rate averages just 5%, because the community is so stable.

The EGI calculations for this example would initially be:

- Rents GPI is $192,000 ($800 rent x 20 units x 12 months)

- Other Income is $15,960 ([$500 parking + $400 storage + $400 laundry +30 late fee] x 12 months)

- Vacancy Costs are $96,000 ($1.92 million x 5%)

- Credit Costs are $1,600 ($800 rent x 2 months)

After taking all of these into account, the EGI for this example multifamily property would be $110,360.

EGI of $110,360 = $192,000 Rents GPI + $15,960 Other Income – $96,000 Vacancy Costs – $1,600 Credit Costs

Commercial Retail Shopping Center Example

As an alternative example, consider a shopping center that has 50,000 square feet of space. The center has some larger and smaller tenants, but the average rent across all tenants is an even $4 per square foot.

In addition to the rents, the shopping center has vending machines and parking revenue for other income. Vending generates $100 monthly, and parking generates $500 monthly.

Vacancy rates average a somewhat typical 5%, and most tenants are stable. One tenant that leases a smaller space for $3,000 is well behind on rent, and likely will have to close. The tenant hasn’t been forced to close yet, however, because the space is a back corner, and it will be difficult to find another tenant.

The EGI calculations for this example would initially be:

- Rents GPI is $2.4 million ($4 rent x 50,000 sq ft x 12 months)

- Other Income is $7,200 ([$100 vending + $500 parking] x 12 months)

- Vacancy Costs are $120,000 ($2.4 million x 5%)

- Credit Costs are $36,000 ($3,000 rent x 12 months)

The EGI for this example would be $2,251,200.

EGI of $2,251,200 = $2,400,000 Rent GPI + $7,200 Other Income – $120,000 Vacancy Costs – $36,000 Credit Costs

Other Factors to Consider When Calculating EGI

EGI can be heavily influenced by any factors that impact local rent rates or vacancies. Because this is a forward-looking metric, changes in rents and/or vacancies must be projected as best they can be.

Investors would do well to check local development plans to see whether any new businesses or developments are underway. Investors also should consider the local economic climate, and how well or poorly a building’s tenants might fare.

Of course, EGI must be considered alongside more comprehensive measures such as NOI and pre-tax cash flow. Income also should be considered alongside appreciation projections.

Wrapping Things Up: Calculate EGI for Your Properties

Anytime you consider a potential commercial real estate investment property, make sure to calculate effective gross revenue as accurately as possible. Use the potential gross income formula and your building’s projections to do so.