What is Equity Multiple in Commercial Real Estate?

Equity multiple represents the absolute return of an investment. It’s widely used in private equity and commercial real estate as a litmus test. There are fewer quick ways to calculate the potential or actual total return of a property (or deal).

What Does Equity Multiple Mean?

Equity multiple demonstrates, in a straightforward way, the total return that investors will receive on their total investment. It’s how much an investment will multiply the invested equity by. In other words, the equity multiplier shows how much investors grow their money by.

How Does Equity Multiple Work in Commercial Real Estate?

Equity multiple is a common metric in both private equity and commercial real estate. Whether making an equity investment in business or property, the calculation is a quick and easy way to measure total return. That can be total expected return when evaluating a potential investment, or total actual return when evaluating how well an investment performed.

Using equity multiple for real estate captures how cash flow and appreciation compare to initial and ongoing investment. How does the money that goes into investors’ pockets compare to the money that comes out of their pockets?

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

How Do You Calculate Equity Multiple in CRE?

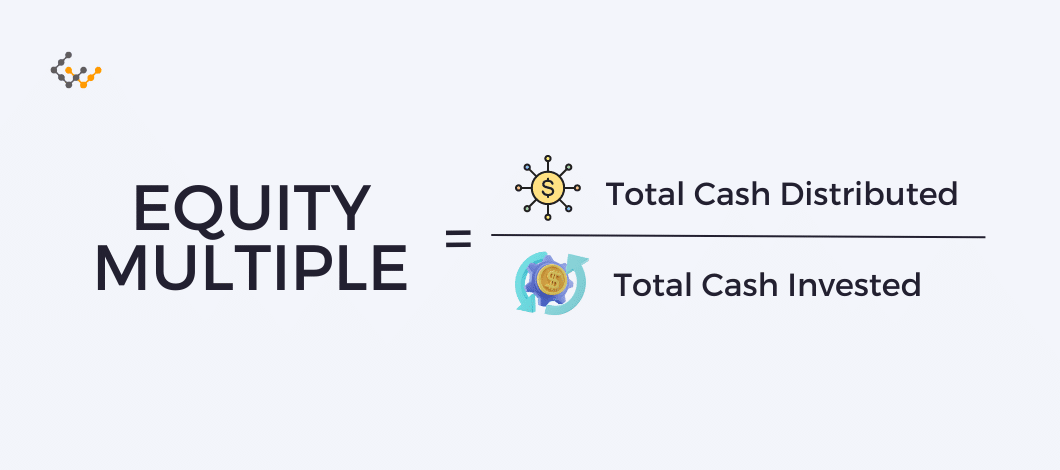

The equity multiple formula is favored largely because it’s informative yet simple. The data points and actual math required for equity multiple calculation are basic, especially when contrasted with what’s needed for other return metrics, such as the internal rate of return.

Here’s the calculation: Equity Multiple = Total Cash Distributed / Total Cash Invested

Total cash distributed encompasses all profits earned. Profits may come in the form of regular cash flow distributions, periodic events (e.g. partial sale, equity recapitalization, cash-out refinance), and sale of the property. Profits also include the original cash that’s received back when a property is sold.

Total cash invested encompasses all contributions that are paid by investors. Contributions here include both the initial funds invested and any funds invested during the holding period, so long as those funds are paid for by investors. Total contributions don’t include investments that are paid for from debt financing, cash flow reserves, or tenants, since these don’t affect what investors themselves pay or receive.

Example Calculations

Example 1: Assume a property was purchased for $12 million, of which $3 million was initially invested at the time of purchase. The property was eventually sold for $14 million, and returned $5 million to investors at the time of sale. During the holding period, the property paid cash distributions of $500,000.

The equity multiple of this example property would be 1.83: Equity Multiple = ($5 million + $500,000) / ($3 million).

Example 2: Assume the same property was purchased and sold for the same amounts, and had the same cash flow distributions. There was also a $5 million addition that was financed but required $1 million from investors. A refinance netted $1 million, of which $750,000 was paid for improvements and $250,000 was repaid as a one-time distribution.

The equity multiple is now 1.44: ($5 million + $500,000 + $250,000) / ($3 million + $1 million)

What is a Good Equity Multiple in Commercial Real Estate?

Investors should at least seek equity multiples higher than 1. An equity multiple of 1 indicates that investors received their contributions back. Any multiple less than 1 means that the property had negative returns, and any multiple higher than 1 means the returns were positive.

Beyond seeking a return above 1, there’s no specific equity multiple that investors should seek. Higher multiples are certainly better than lower ones if all other things are equal. The metric’s beauty is its simplicity, however, and it doesn’t show whether all other things are equal.

For instance, equity multiple doesn’t capture risk level or time. Investors might accept a lower multiple for a low-risk property or one that’s sold quickly. Conversely, they might want a higher multiple for a high-risk opportunity that’s going to be years before all investments are repaid.

IRR vs. Equity Multiple: What’s the Difference?

The difference between internal rate of return (IRR) and equity multiple is time, and this difference is exemplary of equity multiple’s limitations.

Equity multiple fails to account for time. The above examples would hold true regardless of whether returns were paid in 2 years, 20 years or 200 years. An investment with an equity multiple of 1.83 is obviously preferable if it’s paid in 2 years rather than 5 years, but the equity multiple formula doesn’t capture this.

IRR introduces the time value of money, measuring both how much investors receive and how quickly they receive it. An IRR evaluation of the above examples would change dramatically over 2, 20 and 200 years. It’d even be different if returns are paid in 2 years or 2 years 6 months.

Of course, this also demonstrates the beauty of equity multiple. It requires only basic data points, and can be calculated on a napkin or by mental math. IRR requires extended projections of returns and when they’ll be paid, and even then requires calculus to figure out.

These differences are what make equity multiple and IRR useful for different purposes:

- Equity multiple is helpful as a quick litmus test for evaluating properties

- IRR is a more detailed analysis of how one property compares to other opportunities

What Are the Pros and Cons of Equity Multiple

Equity multiple doesn’t show everything that investors need to know when evaluating commercial real estate properties. It answers the most fundamental question of how much an investment will return, however.

Pros

- Shows total expected or actual returns

- Requires only basic data points

- Can quickly be calculated

- Reveals whether an opportunity is profitable

Cons

- Doesn’t account for time

- Doesn’t account for risk

Wrapping Things Up

There’s no better way of calculating total return than using equity multiple for commercial real estate properties. Investors must take many other factors into account when evaluating potential properties, and equity multiple thus shouldn’t be used on its own. It’s one of the quickest metrics to use when initially determining whether an investment is “good,” though, and thus has a place in every commercial real estate investor’s evaluation method.