Federal Reserve’s Reaction to Inflation, Unemployment, and Effect on Interest Rates

Major highlights from last week’s Federal Reserve call include 1) Inflation is currently at 5%, which is above the Fed’s traditional 2% target; 2) The Federal Reserve is looking to pull back some of the quantitative easing it has deployed since the start of COVID; and 3) Before any plans to increase interest rates, the Federal Reserve will be looking to taper off government treasury and agency mortgage-backed securities (MBS) purchasing. As of November, the Federal Reserve was purchasing a total of $120 billion per month, in which $80 billion were treasury securities and $40 billion were agency mortgage-backed securities.

According to the Federal Reserve, the committee decided to double the pace of reductions in its asset purchases of treasury securities and agency mortgage-backed securities by $30 billion per month and to fully cease by mid-March. In addition, three rate hikes are projected for next year, after the asset purchases have tapered off.

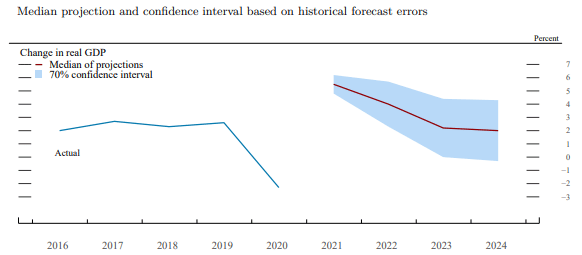

Change in Real GDP Actual and Projected

The median projection for real GDP growth stands at 5.5% this year and is anticipated to decrease to 4% next year.

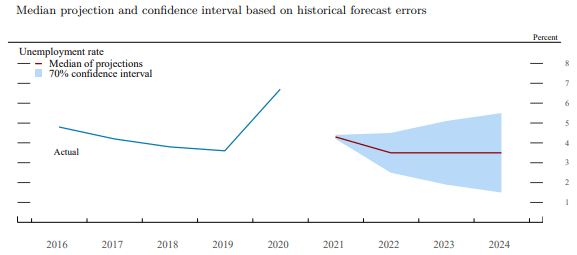

Unemployment Rate Actual and Projected

The median unemployment rate projection stands at 4.2% this year and is projected to decrease to 3.5% next year.

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

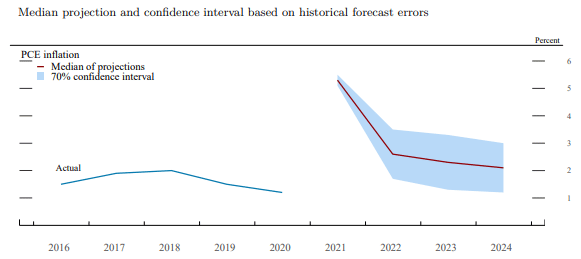

Inflation Actual and Projected

The median projection for inflation is to decrease from 5.3% this year to 2.6% next year.

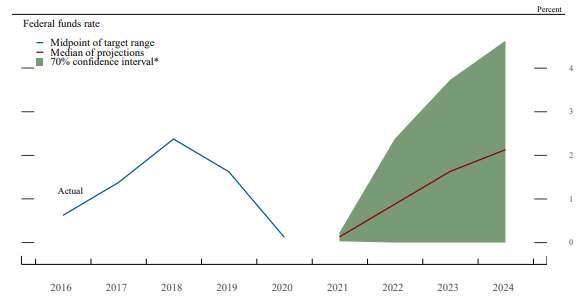

Federal Funds Rate Actual and Projected

The Target range for the federal funds rate is projected to increase 0.25% to 0.90% at the end of 2022.

Original Articles: December 15, 2021, Federal Reserve and Federal Reserve

How has quantitative easing during COVID-19 affected interest rates?

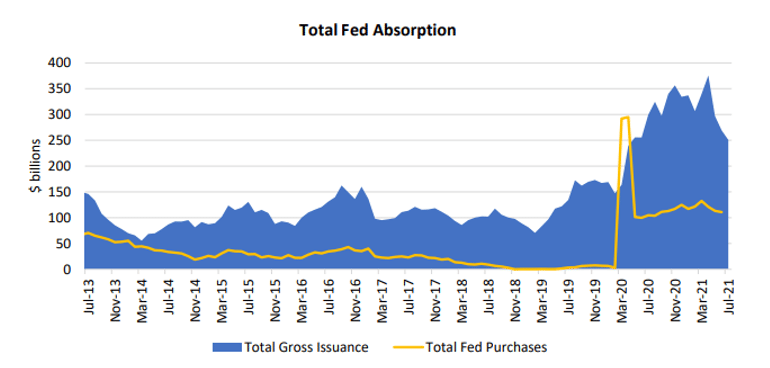

During the second quarter of 2020, the Federal Reserve stepped in to increase demand on treasury bills and agency mortgage-backed securities by purchasing over $100 billion each month. This helped to stabilize the capital markets while also reducing interest rates.

Original Article: September 2021 GinnieMae

The Federal Reserve purchased $98 billion in July 2021 (39% of monthly gross issuance), which was a slight decline from the $110 billion purchased in June 2021 (41% of monthly gross issuance). As of July 2021, according to the Federal Reserve, total agency mortgage-backed securities owned by the Fed equaled $2.4 trillion. Prior to the COVID‐19 intervention, the Fed was winding down its MBS portfolio from the 2014 peak.

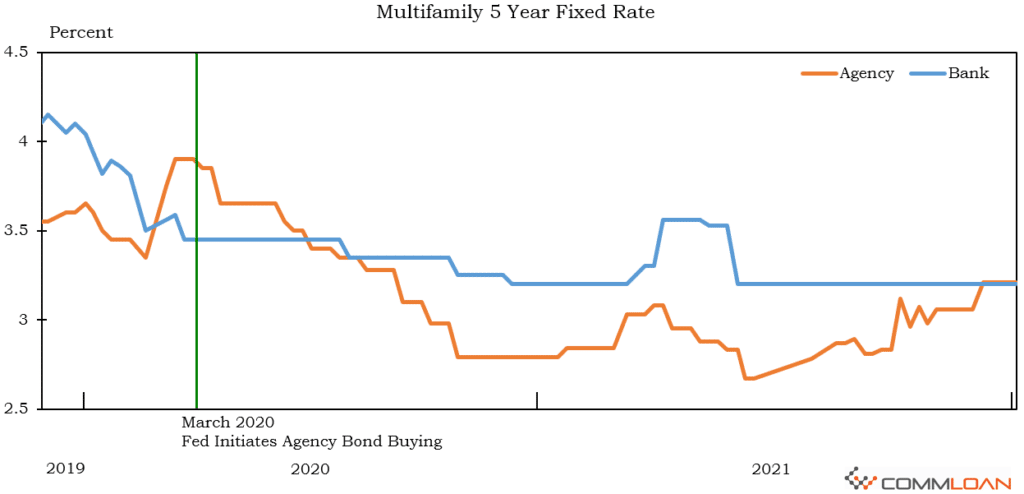

What could the removal of monetary stimulus mean for interest rates?

As the Federal Reserve steps away from this monetary stimulus plan as one of the largest purchasers of treasury bills and agency mortgage-back securities, it will likely cause upward pressure on interest rates in the marketplace. To better understand how this could affect interest rates, CommLoan has prepared the chart below from the data used for our weekly rates distributions over the last 2 years.

The last historical example we have on record was in 2013 when the Federal Reserve tapered its bond-buying program. The Central Bank is trying to avoid roiling markets, similar to when previous Fed Chairman Ben Bernanke triggered the “taper tantrum” in May 2013, when he first indicated a coming reduction in the pace of monthly securities purchases. The benchmark 10-year U.S. Treasury yield jumped from 1.66% to 3.04% from the start of May 2013 to the end of that year.

Original article: November 30, 2021, CNBC

Recommendations to our clients:

For investors who have been waiting on the sideline looking for the best opportunity to refinance a multifamily or commercial property, we are recommending that these prospective borrowers begin working with us immediately. For those concerned about interest rates over the long term or with assets they plan to hold, we are currently procuring loan programs with 7 to 10 year fixed interest rates, which have rate resets built-in after year 5 with aggressive margins over the respective index.

For investors pursuing acquisitions, commercial real estate has historically proven to be a strong hedge against inflation. Many borrowers are selecting lenders who offer a rate lock early in escrow to provide certainty of the fixed rate cost of capital once the transaction closes. Along with expected rent growth, the investor’s internal rate of return (IRR) is likely to improve throughout the holding period with a focus on maintaining positive leverage.